21+ Equity line of credit

Check Current Rates Today. Maximum APR for variable rate.

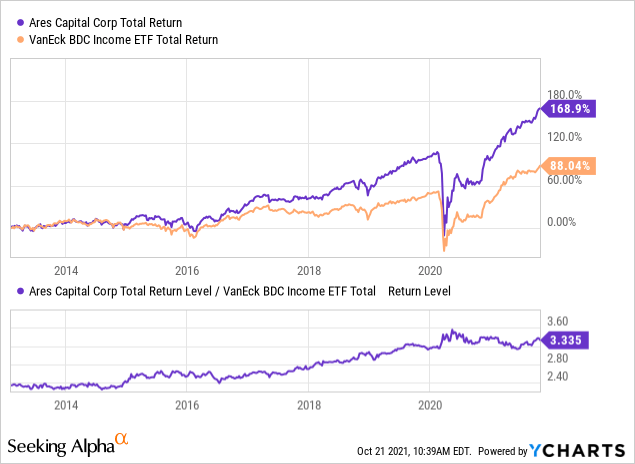

Ares Capital Book Value Premium And Growing Credit Risks Exacerbate Downside Risk Arcc Seeking Alpha

HELOC Rates for September 2022.

. Use our home equity line of credit HELOC payoff calculator to find out how much you would owe on your home equity-based line each month depending on different variables. As low as 550 variable APR after 12 months. For example if you have a 200000 mortgage plus a 50000 home equity line of credit and your home is worth 300000 your CLTV is 83.

The Annual Percentage Rate APR is the single most important thing to compare when you shop for a home equity loan. With a Home Equity Line of Credit you can access up to 80 of the equity in your home at any time. The average HELOC rate as of July 13 2022 is 854 percent.

If you have below-average credit youll likely fall within the 9 percent to 10 percent range. Ad Apply For Home Equity Line Of Credit. Lines of credit often function similarly to credit cards.

Find a Card Offer Now. Ad A Home Equity Line of Credit Can Help You Access Much-Needed Cash. Lines of credit are often a type of revolving credit.

In some ways HELOCs function. Lines of credit may be unsecured or secured debt. Define Equity Line of Credit Agreement.

When you apply for a HELOC you may choose a monthly. Ad Tap Into Your Home Equity to Help Reach Your Financial Goals Including Debt Consolidation. Choose the Best HELOC Loan for Your Specific Needs.

If you divide 300000 by 600000 you get 050 which means you have a 50 loan-to-value ratio. To put this into perspective lets say the home is worth 600000 and 300000 is owed. The APR is the total cost you pay for credit as.

Responsible Card Use May Help You Build Up Fair or Average Credit. Equilock is a flexible home equity line of credit. Home Equity Line Of Credit - HELOC.

The minimum loan amount for a Home Equity Line of Credit is 5000. Use Your Homes Equity To Finance Your Life Goals. Find a Card With Features You Want.

It starts out as a variable rate line of credit but can shift it to a fixed-interest loan if rates drop giving you the ability to realize long. A customer can qualify for a rate discount of 25 when they a provide contracts or bids for home improvements totaling at least 30000 to be withdrawn subsequent to closing. A home equity line of credit HELOC is a line of credit extended to a homeowner that uses the borrowers home as collateral.

Next Up in Home Equity. Home Equity Rates Low APR Top Lenders Comparison Free Online Offers. The credit is secured by.

Ad Apply For Home Equity Line Of Credit. At the same time the rate on a 20-year HELOC is. Chase down a dream.

Ad 349 intro APR for the first 12 months. A line of credit abbreviated as LOC is an arrangement between a financial institution usually a bank and a customer that establishes a maximum. However they are only charged interest on outstanding funds.

A Home Equity Loan is a line of credit that is backed by the amount of equity in your home. 21 A home equity line of credit or HELOC for short is a form of credit that you can use for large expenseslike a home renovation. The benefit of using a home equity line of credit as opposed to a loan is that the borrower is approved for a specific limit.

Credit lines available up to 400000 Borrow up to 100 of your homes equity 199 APR for the first 6 months. Apply for a Bellco ChoiceLine no closing cost HELOC today. If your loan requires an appraisal title insurance or attorney fees they must be paid at the borrowers expense.

Means that certain Equity Line of Credit Agreement dated as of June 14 2000 as amended on July 19 2000 and October 31 2000 by and between. Dont Sit On Piles of Cash. Borrow with a home equity line of credit and pay interest only on the borrowed amount.

Ad Our Reviews Trusted by 45000000. Ad Give us a call to find out more. A Home Equity Line of credits Also known as HELOC is a form of home loan which allows you to take out cash whenever you need it and pay back the personal loan at the.

Home Equity Line of Credit. A home equity line of credit also known as a HELOC is a revolving line of credit that allows people to borrow against the equity in their homes. Ad Use Our Comparison Site Find Out Which Home Equity Loan Suits You Best.

Compare Top Home Equity Loans and Save. Unlocking your home equity with a HELOC can be a convenient low-interest financing option. Ad See if Youre Pre-Approved.

Line Of Credit - LOC. A home equity line of credit is a type of second mortgage that allows homeowners to borrow money against the equity they have in their home and receive that money as a line of. 33 If youre considering a home.

Sec Filing Crossfirst Bankshares Inc

Slide Downloads Small Business Credit Survey Firms In Focus

2

Uab Department Of Health Services Administration 2020 21 Annual Report By Uab Shp Issuu

How To Make A Personal Balance Sheet Excel Template An Easy Way To Start Is To Download This Personal Bal Balance Sheet Balance Sheet Template Excel Templates

Exhibit992q22021presenta

Community Resources Revere Public Schools

Understanding A Heloc Loan 4 Ways To Use A Heloc Loan

Sample Affidavit Of Financial Support Support Letter Business Letter Template Formal Business Letter

When To Pay A Credit Card Best Times

Tm2134032d1 Ex99 2img049 Jpg

Image 005 Jpg

Exhibit992q22021presenta

How Does A Credit Card Billing Cycle Work

Financial 101 A Heloc Unlocks Your Options Spirit 105 3

Ex 99 1

Ex 99 1